Do I Have To Pay Oklahoma State Income Tax On Gambling Winnings

Whether it’s in Las Vegas, Atlantic City or the local casino, thousands of people dream of winning big and changing their lives forever.

- Yes, you must pay taxes on gambling winnings from a casino. A more detailed explanation of how gambling winnings are taxed can be found above. You are legally required to report your income from all types of gambling activities.

- Everyone is required to report gambling winnings over a certain amount, and in many instances casinos will take your information and issue a1099. Whether or not you pay taxes on them is dependent what your income level is.

Do I Have To Pay Oklahoma State Income Tax On Gambling Winnings 2019

Most people that go end up with thinner wallets than what they went with but there are the occasional few that take home the big bucks.

However, if Lady Luck is on your side, you don’t get to keep all the money to yourself.

Gambling winnings count as taxable income, meaning that it’s not just your lucky day; you get to share it with the Internal Revenue Service (IRS).

So before you spent it all have the taxman knocking on your door for its share of the spoils, you must understand how gambling taxes work.

Yes, you do get to deduct the losses so you don’t pay income taxes on the winnings, but that is only part of the story. The rest of the story has to do with how gambling winnings affect your Modified Adjusted Gross Income (MAGI). Thinking that just because you are not a resident of Oklahoma, you are not obligated to file and pay an Oklahoma state income tax return. In reality, if you earned more than $1,000 for the year in this state, you are required to file a non-resident income tax return even though you do not live in Oklahoma.

Whether it’s sports betting, poker, fantasy sports, casino or even the lottery, everything you win from gambling is taxable. While this may cause you to sigh or to grit your teeth, unfortunately, that’s just the way it is.

This guide will show you everything you need to know about gambling taxes, including how they are taxed, the important requirements you must fulfil and how to report your gambling income.

How Gambling Winnings Are Taxed

The federal income tax process with regard to gambling remains the same across the US.

Unlike income tax, US gambling taxes are not progressive. No matter how small or how large you win, you are required to pay 25% to the IRS.

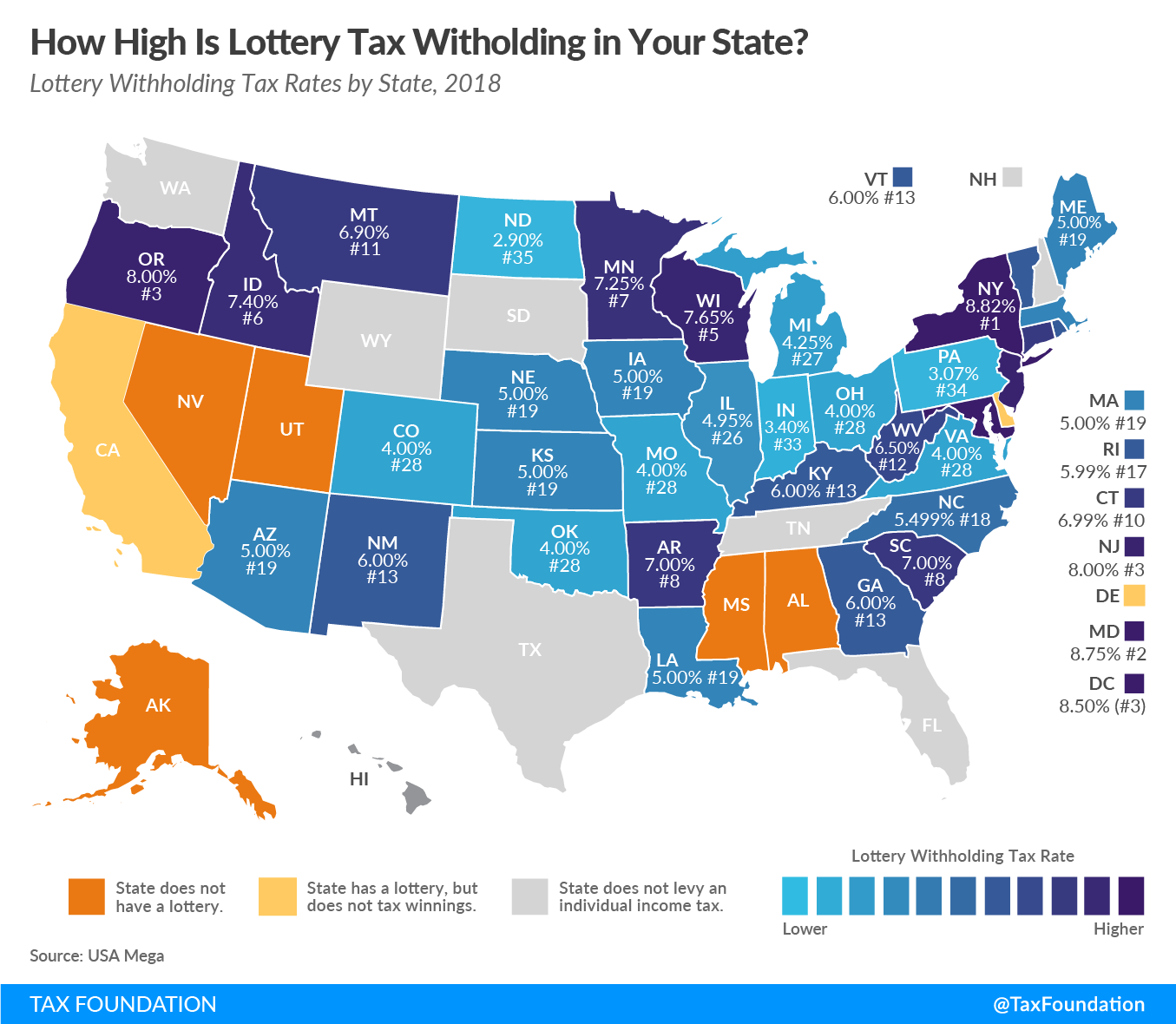

However, things can be different at the state level.

Each state in the US has its own tax structure. Therefore, you must first find out the tax structure of your state of residence.

Here’s a brief summary of how you can expect federal and state law to tax your gambling winnings.

First of all, you must know where your winnings came from, specifically the type of game which you were playing and cash out from.

There are certain thresholds you must meet, and they are as follows:

- $600 or more at a horse track or 300x your original bet;

- $1,200 or more from slot machines or bingo;

- $1,500 or more at keno;

- $5,000 or more playing poker

Now, for example, if you won $1,000 from horse racing and won $5,000 playing poker, you don’t report a lump sum of $6,000 won from gambling. Instead, you report each individual game.

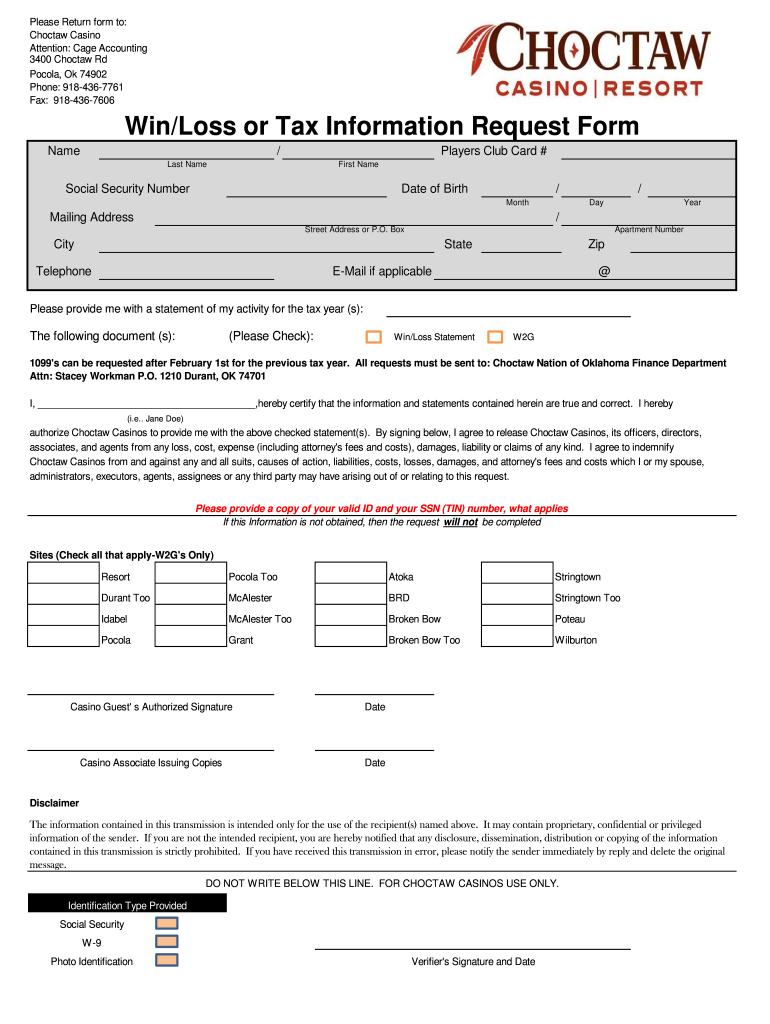

This means that in the event you do win big, racetracks and casinos will require your Social Security Number before they pay you your winnings. You are also required to fill out IRS Form W2-G and report your winnings.

The reason for this detailed breakdown of winnings is because the casino will deduct 25% from your winnings before paying you. This is the money you are taxed by the US Government and you will be issued a receipt by the casino as proof.

But what about the gambling taxes on winnings less than the above thresholds?

As per the IRS, you must report them on your federal tax return as income.

It’s better to be safe than sorry, so always report your gambling winnings, no matter how small they are. Even if it’s just a few dollars from the slots, write it down.

Some states have an income tax rate of their own. If so, you must report your winnings on your state tax return too. This is particularly important now that gambling is becoming legal.

It’s worth mentioning here though that Nevada, the only state where gambling in a casino was legal, did not use to tax gambling income. Always check your state’s laws to see if you are legally required to report gambling winnings.

Many questions are asked about online gambling winnings and how they are taxed.

Online gambling taxes are in a bit of a grey area. Currently, online gambling is illegal in most states anyway but in those where it is legal, most are in the form of online sports betting. This is subtle but very important to be aware of.

The IRS specifies what is classed as taxable income and what is classed as non-taxable income.

Those that play daily fantasy sports for a living through DFS contents must be careful when it comes to gambling taxes.

For those living in a state where online sports betting will become legal in the future, through an online sportsbook, it’s recommended to read IRS Publication 525. It goes into detail about what they class as taxable income and what they deem as non-taxable income.

It’s rare for gambling winnings to be categorized as non-taxable income. Therefore, if you do win money from online gambling, be prepared to treat it exactly the same as you would for gambling winnings in a traditional casino.

Reporting Gambling Winnings To The IRS

One of the main reasons state governments want to legalize sports betting is because of the potential windfall of cash.

This means that they will be putting a lot of effort into making sure they get as much as possible from players’ winnings.

Not reporting gambling winnings to the IRS and/or state government is a much bigger risk than the games you are playing.

With the lottery, for example, the state will obviously be made aware of winning tickets. It’s also certain that the federal government will be made aware of the winner too.

In terms of gambling, each state in the US has a gaming commission. They are responsible for keeping an eye on all gambling activities.

Casinos have an obligation to report all winners to the gaming commission, so any plans to avoid reporting winnings should be short-lived.

If you do not report gambling winnings, you risk being pursued by the government for tax evasion.

If you are then found guilty of tax evasion for not reporting your gambling winnings, you will face the same consequences as people evading tax on other taxable income.

Casinos’ Gambling Earnings Reports

As part of their operating license, casinos must report winnings to the IRS. However, they are required to report gambling winnings at the same thresholds as if it was an individual:

- $600 or more at the horse track or 300x your original bet

- $1,200 or more playing bingo or on slot machines

- $5,000 or more from poker

There are certain games that casinos are not required to issue Form W2-G or withhold taxes. These games include roulette, blackjack and craps.

Do I Have To Pay Oklahoma State Income Tax On Gambling Winnings Calculator

The reason for this isn’t so clear cut. The IRS says that table games require a degree of skill while slot machines come down to pure chance. But casinos find it tough to be certain how much a player cashes out with compared to the amount they started with.

Nevertheless, just because you don’t get From W2-G or don’t have taxes withheld from these games, you are still required to report all of your winnings to the IRS.

Do it yourself when it’s time to file your taxes.

Professional Gamblers

Some people gamble professionally for their livelihood.

For these players, gambling winnings are considered regular income for tax purposes, meaning that they are taxed at the normal income tax rate, rather than the gambling tax rate.

All income and expenses for professional gamblers much be recorded on Schedule C, not Schedule A.

Gambling Winnings Records

Always report your gambling winnings; the consequences of not doing so are not worth facing.

With all this in mind, keep a record of all your receipts. This includes both winning and losing sessions. Gambling losses can also be deducted against income but without proof, you will not be able to claim these losses. Good record keeping will ensure you can itemize your losses and use them to offset against your income.

Here are a few things you should record:

- The type of bet

- The date of the bet

- The name of the casino or sportsbook you bet with

- The casino’s or sportsbook’s address

- The names of people you were with

- The total amount you bet

- The total amount you won or lost

- Documentation as evidence of your placing your bet

In terms of the documentation, here are some examples you can use.

For keno winnings, keep a copy of the tickets you bought as validated by the casino, your credit records and check-cashing record.

For slots winnings, record the slot machine number you won from, how much you won each time and the date that you played that machine.

For table games winnings, such as poker, blackjack, baccarat and craps, record the number of the table you were playing at and, if applicable, any information where credit was issued by the casino.

For bingo winnings, make a record of the game numbers you played, the price of the ticket and how much you collected.

For horse and racing winnings, make a record of the race you bet on, how much you bet and how much you won on the winning ticket and how much you lost on a losing ticket. Include any unredeemed tickets as supplementary evidence.

Finally, for lottery winnings, make a record of the tickets you bought, the dates you bought the ticket, how much you won from a winning ticket and how much you lost from a losing ticket. Again, you can include any unredeemed tickets as supplementary evidence.

If you gamble casually from time to time and you miss a few receipts on accident, you will be fine. Just make sure you are accurate with your reporting next time.

There are two IRS forms you must complete to report gambling winnings: the U.S. Individual Tax Return 1040 and IRS Form W-G2 Certain Gambling Winnings.

All profits from gambling are subject to a 24% gambling tax.

However, some sources of gambling winnings are automatically subject to withholding tax.

For more information on this, see the IRS guidelines.

They will help prevent you from making mistakes on your tax form and reduce the shock of being faced with a big bill at the end of the financial year.

Frequently Asked Gambling Taxes Questions

Do I Have To Pay Taxes On Gambling Winnings From A Casino?

Yes, you must pay taxes on gambling winnings from a casino. A more detailed explanation of how gambling winnings are taxed can be found above. You are legally required to report your income from all types of gambling activities.

Different games have different guidelines for when the income becomes taxable, but each must be reported on the tax return. Keep an organized record of all winnings and losses, which can be used to offset against profits.

Do I Have To Pay Taxes On Gambling Winnings From An Online Casino?

Yes, you must also pay taxes on gambling winnings from online casinos. This is because federal and state governments categorize winnings from gambling as income you are generated in an attempt to make more.

It doesn’t matter if it’s from playing the odd slot machine on your smartphone or from the poker table on your computer at home. As long as you win, the IRS wants their share.

Do I Have To Pay Taxes On Winnings From Daily Fantasy Sports?

Once again, yes, you must pay gambling taxes on winnings from DFS. Providers of these games will be documenting your winnings to the federal government. If you try and avoid paying taxes on daily fantasy sports winnings, you can land yourself in a lot of trouble.

Do Non-US Residents Have To Pay Gambling Taxes On Gambling Winnings?

Yes, non-US residents must pay taxes on gambling winnings. Whether it’s in the lottery or in a casino, they must pay a percentage of their winnings to the federal government. Non-residents must complete and file IRS Form 1040NR.

Gambling income for non-residents is taxed at 30%.

Unlike US residents, non-resident aliens cannot deduct gambling losses from their tax bill.

However, a tax treaty between the US and Canada allows Canadian citizens to deduct gambling losses up to the amount of their gambling winnings.

Can I Write Off My Gambling Losses On My Tax Return?

Yes, you can write off gambling losses on a tax return.

You must first report some gambling winnings, so having a record of your results will be very useful. From here you can start to itemize tax deductions for all losses.

Nonetheless, there is a limit on the losses you can claim; it depends on how much you won.

In order to claim tax deductions, you must be able to prove you actually lost the money. This places even more emphasis on keeping your gambling records in order.

At the end of the day, you are deducting losses so you aren’t required to pay income tax on your gambling winnings. This is important as it impacts how the winnings affect your Modified Adjusted Gross Income (MAGI).

MAGI is based on all of your other tax deductions. It helps to determine if you need to pay more tax on other income or lose some of your deductions.

Do I Have To Pay Taxes If I Keep All My Money In My Account?

Even if you don’t withdraw your winnings from your account, you must still pay taxes. After all, you have still profited from gambling. Record all of your winnings throughout the year and report them on your tax return according to the IRS guidelines.

Am I Taxed On Group Gambling Bets?

Yes, you are taxed on group or team gambling bets. In fact, it’s the same the tax system used to gambling winnings for individuals.

If you are betting with a team, it becomes even more important to track your bets and keep a record. You don’t want to be taxed on the entire payout when you only took home a percentage of it.

Do You Need To Report Gambling Winnings After You Retire?

Even if you’re retired, you can still be taxed on gambling winnings. If anything, it is even more important when you’re retired to report gambling winnings. If you don’t, you can run into a few problems.

For starters, if you don’t report gambling winnings, you can be moved into another tax bracket. You could even have medical coverage changed and the premiums could increase too.

All because you didn’t report your bingo winnings to the IRS.

Be diligent with your reporting and ensure it’s all accurate, even during your retirement.

Summary

If you had no idea about gambling taxes and what you need to do, these basic principles should give an idea.

Above all else, make sure you always report your gamblings. It’s a much better alternative than being hit with a massive tax bill at the end of the year.

It’s also a good idea to keep records of your winnings too. These can be used to deduct losses and you will also know how much you need to pay in taxes from your winnings before the bill even arrives.

It might seem a bit over the top to keep winnings receipts if you gamble every once in a while. But in the eyes of the IRS, there’s always a chance you won big.

Tags

Gambling earning reportsgambling taxesprofessional gamblers Advertiser Disclosure

Advertiser DisclosureWe think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

This article was fact-checked by our editors and Jennifer Samuel, senior product specialist for Credit Karma Tax®.

Gambling may just be a hobby to you, but there’s nothing casual about it when it comes to filing your federal income taxes.

Nearly two-thirds of Americans gamble, according to a 2016 Gallup poll. And while you might think that winning a few bucks from a scratch ticket or a weekend trip to Vegas isn’t a big deal, the government considers every dollar you win from gambling as taxable income.

As a result, it’s important to understand how to report your gambling winnings, what to include and how you can use your losses in your favor. Here are some things you should know about how gambling winnings are taxed.

1. You must report all your winnings

Depending on how much you won during the year, you may receive a Form W-2G listing your gambling winnings. But even if you don’t receive the form, you’re still required to report all your winnings as “other income” on your tax return.

“All cash and non-cash gambling winnings are taxable and should be reported as ‘other income,’ ” says Patrick Leddy, partner at Farmand, Farmand & Farmand LLP. This includes any winnings you received from casinos, lotteries, raffles or horse races. Non-cash winnings, such as prizes like cars or trips, are also considered taxable income and are taxed based on their fair market value.

To make sure you keep track of both your winnings and losses, record the following details every time you gamble:

- The date and type of your gamble or gambling activity

- The name and location of the gambling establishment

- Names of other people who were with you, if applicable

- How much you won or lost

- Related receipts, bank statements and payment slips

2. You can deduct some losses

No one likes to talk about how much money they lost gambling. But when it comes to your tax return, being honest can save you money. That’s because the IRS allows you to deduct gambling losses.

Though you may not be able to deduct all your losses.

“Taxpayers can deduct gambling losses only up to the amount of their gambling winnings,” says Leddy, “and only if they itemize their deductions.”

For example, if your gambling winnings totaled $5,000 in the tax year, but you lost $6,000, you can only deduct $5,000 of those losses. Keep in mind, itemizing your deductions may not afford you the maximum tax benefit. If your total itemized deductions — which can also include charitable donations, home mortgage interest and medical expenses — don’t exceed your standard deduction, itemizing might not be the optimum choice for you.

Can I deduct the cost of a gambling addiction recovery program?

IRS Publication 502 lists alcohol and drug-related addiction-recovery programs as eligible for the medical expense deduction. However, gambling addiction isn’t included. If you need help dealing with a gambling addiction, you can call the Substance Abuse and Mental Health Service Administration’s 24/7, 365-days-a-year hotline at 1-800-662-4357.

3. Even illegal gambling winnings are taxable

According to the American Gaming Association, it’s estimated that Americans spend more than $150 billion per year on illegal U.S. sports betting — and yes, that can include your office March Madness pool.

A May 2018 U.S. Supreme Court ruling opened the door for states to legalize sports betting, but not all have done so. That said, any winnings you receive from betting on sports legally or illegally (or from any illegal activity, for that matter) are still taxable.

Learn more about sports betting and taxes

Bottom line

So how are gambling winnings taxed? Every dollar you win from gambling, whether legally or not, is considered taxable income. As a result, it’s critical that you keep a record of your winnings so that you can report them accurately. You’ll also want to keep track of your losses so that you can use them to qualify for a tax break.

Once you’re ready to file your taxes, Credit Karma Tax® can help show you where to include both your winnings and your losses so that you can maximize your tax refund if you’re owed one.

Jennifer Samuel, senior tax product specialist for Credit Karma Tax®, has more than a decade of experience in the tax preparation industry, including work as a tax analyst and tax preparation professional. She holds a bachelor’s degree in accounting from Saint Leo University. You can find her on LinkedIn.